Direct, Indirect, and Induced Benefits of Real Estate Investment

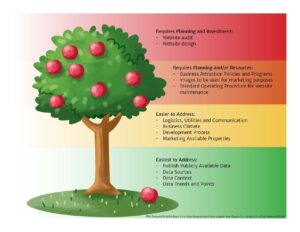

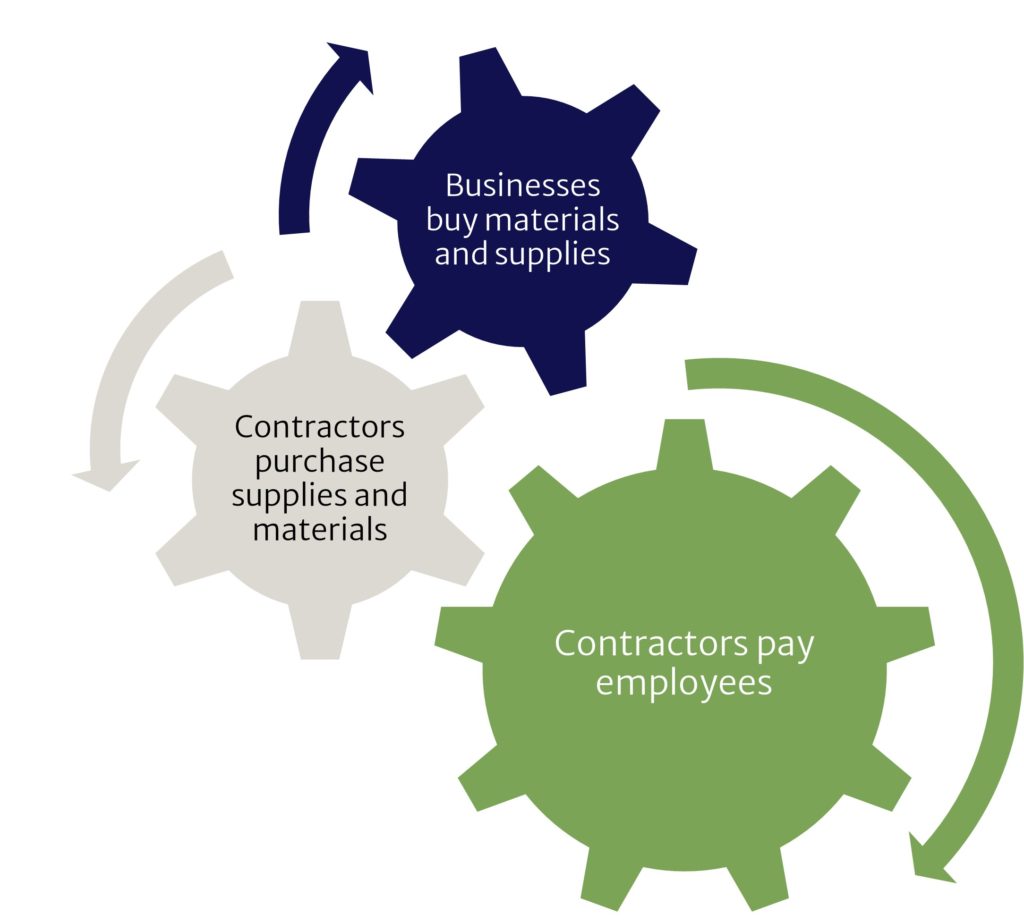

Investment in maintaining the façade, interior updates, and routine maintenance create benefits beyond the four walls of that particular property. In the practice of economic impact analysis, there are three types of impact we measure: direct, indirect, and induced impact.

The Direct Economic impact of an investment measures the total amount of additional expenditure within a defined geographical area directly attributed to a construction project or other investment of capital.

Indirect impact includes the impact of local companies buying goods and services from other local companies. In the case of commercial real estate investment, indirect impacts are the goods and services purchased from suppliers by the direct investment noted above. Spending cycles backward through the supply chain until all money is either spent outside of the local economy through imports or by payments to value-added.

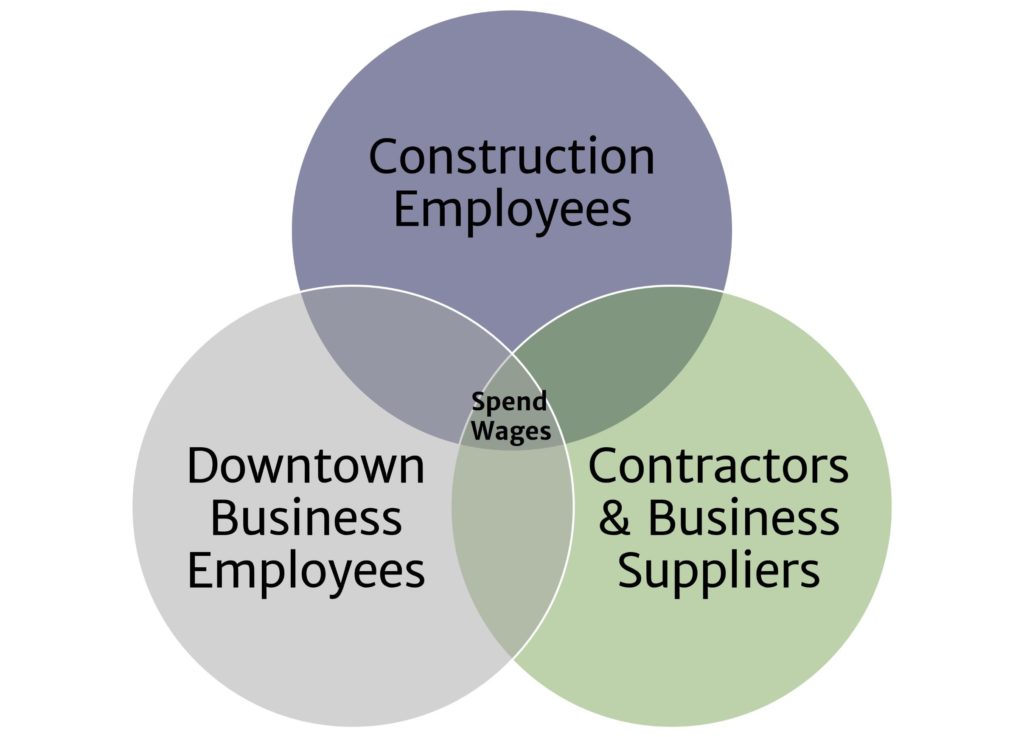

Induced impacts are the result of increased personal income due to the direct and indirect effects. The induced effect is a measure of this increase in household-to-business activity. For example, as employees of contractors, suppliers and manufacturers receive their wages, this creates induced impacts.

Case Study: Watertown, WI

By way of example, allow me to share what happened in Watertown, WI. The Redevelopment Authority (RDA) created a downtown commercial rehabilitation revolving loan fund. Capitalized with $600,000, it was for property owners to make improvements in their buildings in the historic Main Street District. Loans made by the RDA leveraged an additional nearly $500,000 of owners’ cash and matching grant funds. At the same time, the RDA committed to removing a block of blighted buildings and investing in a world-class Town Square. Estimated construction value for the Town Square project was $3.2 million.

The funds were loaned out very quickly. The RDA also granted $20,000 to Main Street Watertown to provide supplemental grant funds to separate projects. Momentum grew and soon property owners were investing in their properties outside of the program.

Interest also grew for acquisition of properties that were for sale. Local investors purchased properties seeing their future value.

Outside the RDA’s loan program, in 2020 alone, 23 building façade projects were completed. Nine projects received façade grant funding from Main Street Watertown, and interior work occurred. Exterior work started on an additional seven buildings. Total investment in building rehabilitation came to more than $400,000.

By encouraging investment in private properties, the RDA’s loan program helped encourage others to acquire and improve properties. All of those investments impacted the construction crews, suppliers, and employees who worked on the projects and in the businesses.

Through owners’ improvements to downtown buildings as well as the RDA encouraging and facilitating investment in downtown, foot traffic and sales are due to increase as well. While multipliers are questionable and hard to value, the investments made by property owners in downtown Watertown and in your community will reap benefits beyond the businesses making the investments.

Conclusion

The benefits of real estate investment extend beyond the property’s owner or tenant. Yes, investments will lead to increased sales, increased property taxes, and increased foot traffic. However, the community will also experience increased investment by others, increased interest from residents, visitors and businesses interested in being a part of the buzz.